Overview

Enterprise risk refers to the measurement and management of risk as faced by a company. One of the primary sources of risk, financial risk, is detailed in financial risk.

However, enterprises face non financial risks as well. The measurment of these risks can be more difficult than financial risk.

Steps to Enterprise Risk

There are many frameworks for managing enterprise risk. The following represents a simple and common set of steps.

Addressing Risk

There are generally three ways to address a risk once it has been identified.

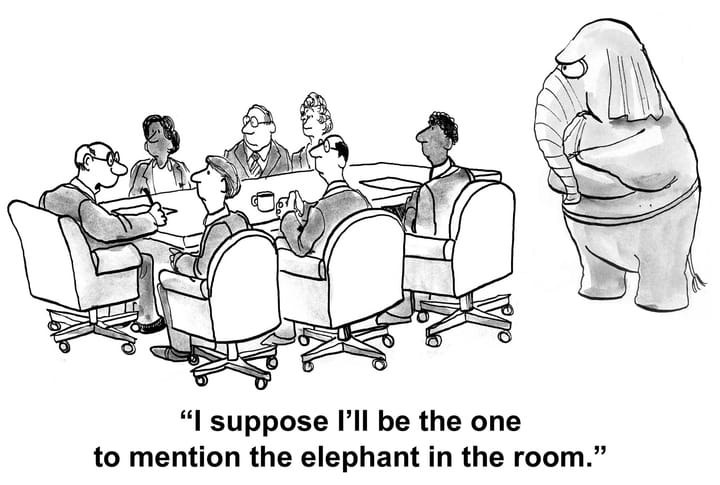

- Accepting Risk: The first choice is to merely accept the risk. Even though nothing is being done to address the risk, the risk has been identified up to management who is know explicitly aware of the risk.

- Mitigating Risk: is the process of finding ways to lessen the risk, or possibly the impact of the risk. Risks can be mitigated by allocating more resources to the identified problem, or when the risk is out of the control of management, by diversification or hedging.

- Risk Transfer: is the process of finding a third party willing to bear

a giving risk, usually for a fee. The classic example of risk transfer is the purchasing of

insurance

against the risk.

Risk transfer can create new risks that need to be monitored. In particular, when buying insurance, the insurer could become insolvent prior to having to pay a claim. Hence, buying insurance adds an element of credit risk to a company's books.

Enterprise Risk and Industry Structure

The structure of an industry (in terms of the cost structure, competitors and consumers, see Porters Five Forces) can have an impact on the risks that an enterprise will face.

In particular, a firm with high fixed costs faces elevated risk when there is a downturn in the economy or consumer spending. In such a case, the firm cannot just decrease costs through lower production. (That is, the firm faces a set of fixed costs that will not go away as production decreases)

Industries with high fixed costs often face fierce competition during a downturn (assuming the presence of competitors) as companies try to grab market share in order to cover its fixed costs. It is often critical for an enterprise to plan ahead of downturns

- Move fixed costs to variable costs, where possible

- Build a capital buffer

- Have a strategic plan to garner market share in a downturn

Enterprise Risk in Financial Firms

Enterprise risk is more complex when dealing with financial firms. The theory has been developed in both banking and insurance industries and is generally subsumed under different names, depending on the industry.

In both cases, the objective is determine how much capital is needed in order to create an appropriate buffer to financial losses. Both industries are highly regulated, and the size of their capital buffer is a key interest of regulators.

- Economic Capital (banking)

- Ruin Theory (insurance)